By Edmund Magnus

July 20 2020, 11.15

Follow @SW_Londoner

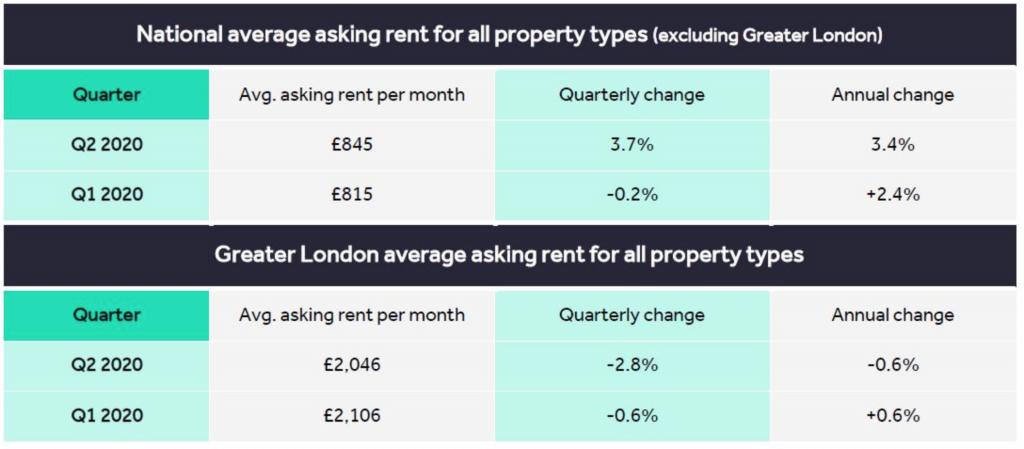

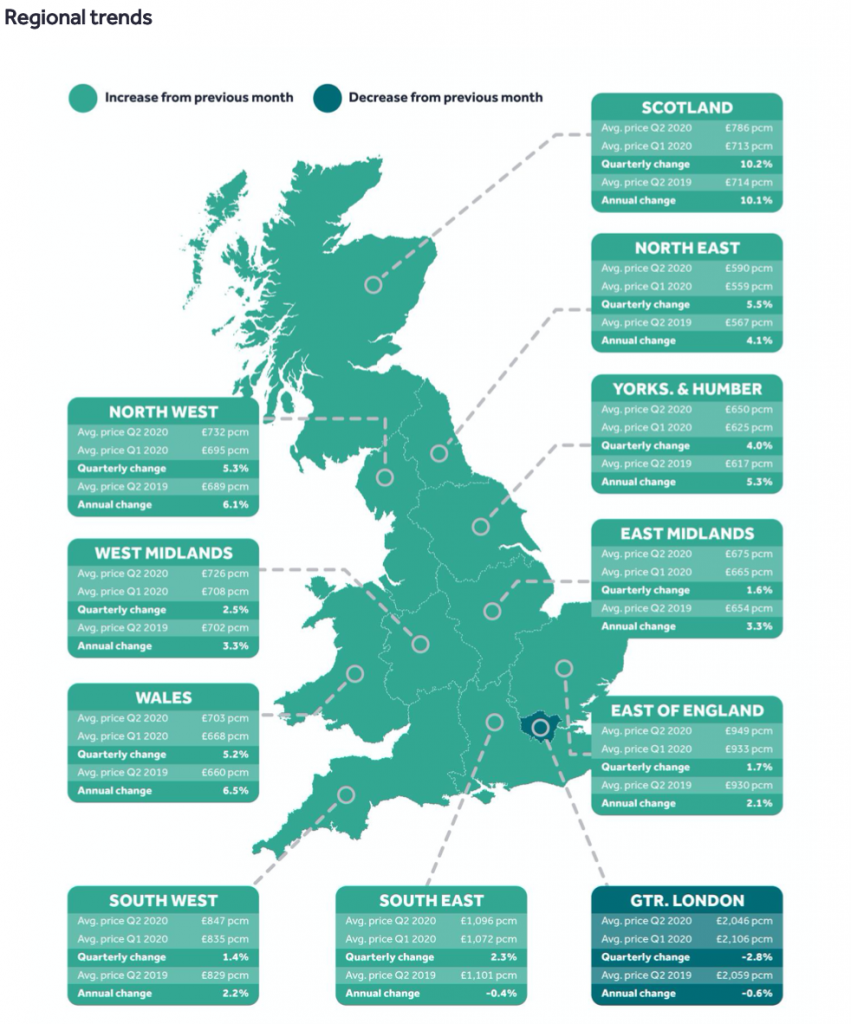

London’s rental prices are falling amidst reduced demand and an oversupply of properties, according to the latest data released by Rightmove.

The total number of available rental properties is currently up 41% in London compared to this time last year.

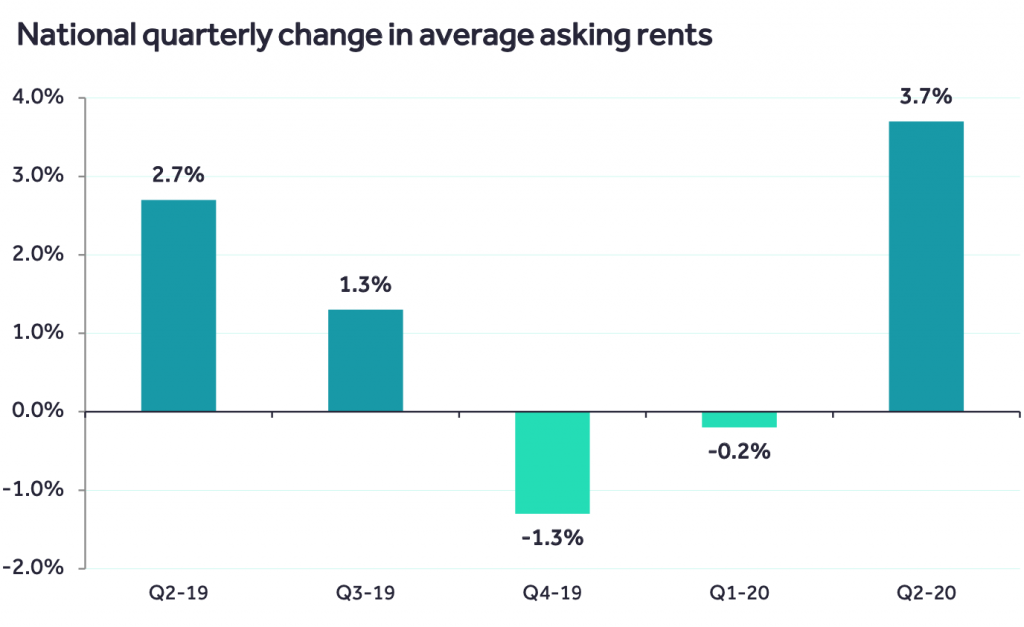

London’s rental prices dropped 2.8% between April and June. Rightmove suggest this is fuelled in-part by a surge in long-term rental supply as landlords using their properties for short-term holiday lets via Airbnb are now making the switch to try and find long-term tenants.

Rightmove’s commercial director and housing market analyst Miles Shipside suggested that, while rental supply in London is surging, rental demand in the capital is also reducing.

He said: “There are early signs that some existing London renters are looking to move further afield, adding to the large increase in the number of properties up for rent on Rightmove in the capital.”

Signs of a possible London exodus are being seen in the data, with asking rents outside the capital rising 3.7% between April and June this year.

Phone and email enquiries to estate agents hit a new all-time high on July 6.

According to Rightmove, overall rental demand across the UK is now 40% higher than it was this time last year.

With rental demand outside London at a record high, this may lead to further upwards price pressures in other parts of the country.

In London, however, the issue of over-supply may mean this is a perfect time for renters to be looking for better deals.

Mr Shipside explained: “Many renters may feel they’ve been left out of the Chancellor’s recovery packages, but one glimmer of hope is that we could see more choice for tenants and, in turn, prices may stabilise for a while, but it will take some time.

“Prospective tenants could find there’s some room to negotiate especially if they are happy to sign a longer term contract.”

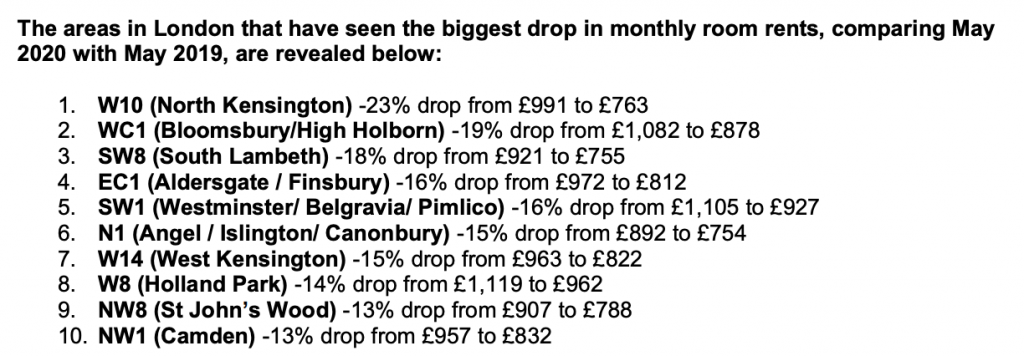

The new data released by Rightmove comes following a report by SpareRoom last month which looked at the cost of renting a room in a house share.

The report revealed London rental prices on SpareRoom had fallen 7% on average year on year since May 2019.

In West London, the most dramatic falls were seen in North Kensington (-23%), South Lambeth (-18%) and West Kensington (-15%).

SpareRoom director Matt Hutchinson said: “We’re starting to see the entire city becoming more affordable, which could spur a flurry of movement as people seek out cheaper rents than they currently have.”

Over the coming months, there is a possibility that supply of rental properties in the capital will increase as buy-to-let investors attempt to take advantage of the stamp duty holiday recently announced by the Chancellor.

A new survey conducted by Rightmove among landlords has found that, despite growing concern over risks of greater rent arrears, a quarter of them are still planning to increase the number of buy-to-let properties they own.

Prior to the stamp duty cut, an investor buying a second property in the capital for £500,000 would have paid £30,000 stamp duty. That has now been halved to £15,000.

According to Rightmove, the immediate effect of the stamp duty cut in England has been to unleash a surge in buyers’ activity.

Year-on-year buyer enquiries are up 75% in the UK since the start of July.

The number of sales agreed in the five days after the announcement (between July 8 and 12) was up by 35% on the same days a year ago.

It remains to be seen whether rental prices in the capital will continue to fall, but the data is suggesting that now might be a good time to be looking to rent in London.

Feature image courtesy of Paul Maguire via Shutterstock