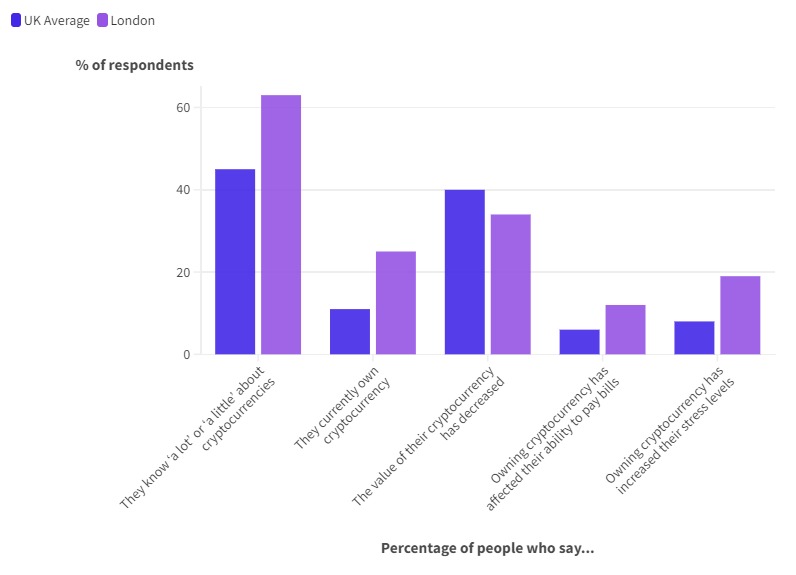

Twelve percent of London cryptocurrency owners say that investing in the virtual markets has affected their ability to pay essential bills, according to a survey.

The research, carried out by YouGov and commissioned by gambling support charity GamCare, reveals that nationally people are more likely to have lost on investments than gained, with 34% of London investors reporting the same.

In the past two years more than 200 people have called the National Gambling Helpline, operated by GamCare, to receive support for struggles in online financial markets.

Raminta Diliso, financial harm manager at GamCare, said: “What we have seen on the National Gambling Helpline over the past few years is that serious harm can occur if it goes too far, and it’s not always the get-rich-quick opportunity some people may think it is.

“The volatility and unpredictability of these currencies can sometimes create a similar environment to gambling, where people are starting to chase the rush rather than feel they are engaging in a financial activity.”

The YouGov research notes that, nationally, those gambling at harmful levels were almost five times as likely to own cryptocurrency than the general population, whilst also experiencing more negative impacts.

Of this group, 23% said that it made them want to invest more in crypto to recover losses.

Chair of the Treasury Committee, Harriet Baldwin MP, said: “Trading of cryptocurrencies, like Bitcoin, is equivalent to gambling.

“The sharp peaks and drops in the value of cryptocurrencies clearly demonstrates the risks that speculating on them can pose to consumers.”

The survey found that in London 19% of crypto owners said that it has increased their stress levels, as opposed to 8% nationally.

The National Gambling Helpline has seen examples of people losing upwards of £50,000 as well as young adults who have invested in cryptocurrency in order to try and get on the property ladder.

One caller, Michael, explained how his stable career as a professional poker player gave way to a cryptocurrency obsession that saw him sitting on a portfolio of $3million, much of which was lost.

He said: “I had the mentality of a gambler.

“My endorphins were rushing and started to feel similar to gambling; you never have enough money, but this wasn’t real money as I still hadn’t cashed it in.

“I thought if it was worth $3million, I could easily get it to $5million or $10million.”

Michael eventually sought help from the National Gambling Helpline and was referred for support.

He added: “They told me that I could still have my family, rebuild my life, and accept the money is gone.

“I told myself it would be better without it, and their words got through to me where they hadn’t before.

“So a switch went for me, which I wish had happened earlier, but I started to go to Gamblers Anonymous as I didn’t ever want that switch to get turned back on.”

GamCare is a leading provider of information, advice and support for anyone harmed by gambling in Great Britain. More information on their services can be found at https://www.gamcare.org.uk/.

Featured image credit: WorldSpectrum/Pixabay