“It feels like your house is built on shifting sand. It feels like you’re an inconvenience, like everyone is saying: just go away and die.”

Jo Leigh, who lives in Chessington, was diagnosed with multiple sclerosis (MS) 12 years ago and rheumatoid arthritis six years later.

She began claiming benefits around the time of her MS diagnosis.

Jo has been shielding since March 2020 after being told that if she contracted coronavirus she would have less than a 50% chance of survival.

During the pandemic the price of her weekly shop has gone up as she is not able to get in-store deals, and often has to pay for deliveries.

She said: “Cooking and preparing things is actually impossible for me, my hands are so twisted from the arthritis. I simply can’t peel a potato or lift a saucepan, so I just eat Iceland £1 ready meals.

“My heating bills are hideous because I can’t move if I’m cold, so I’ve been having to skimp on that. All that’s been keeping me sane is the TV, and I’ve cut the service down to as small as I possibly can.”

She cancelled her mobile phone contract, because she wasn’t able to afford it, making her even more isolated as she shields alone in her home.

Jo claims legacy benefits, an older style of benefit which is being replaced by Universal Credit.

She receives Disability Living Allowance and income-based Employment and Support Allowance with a Severe Disability Premium.

Jo is not alone in facing increased costs of living as a disabled person during the pandemic.

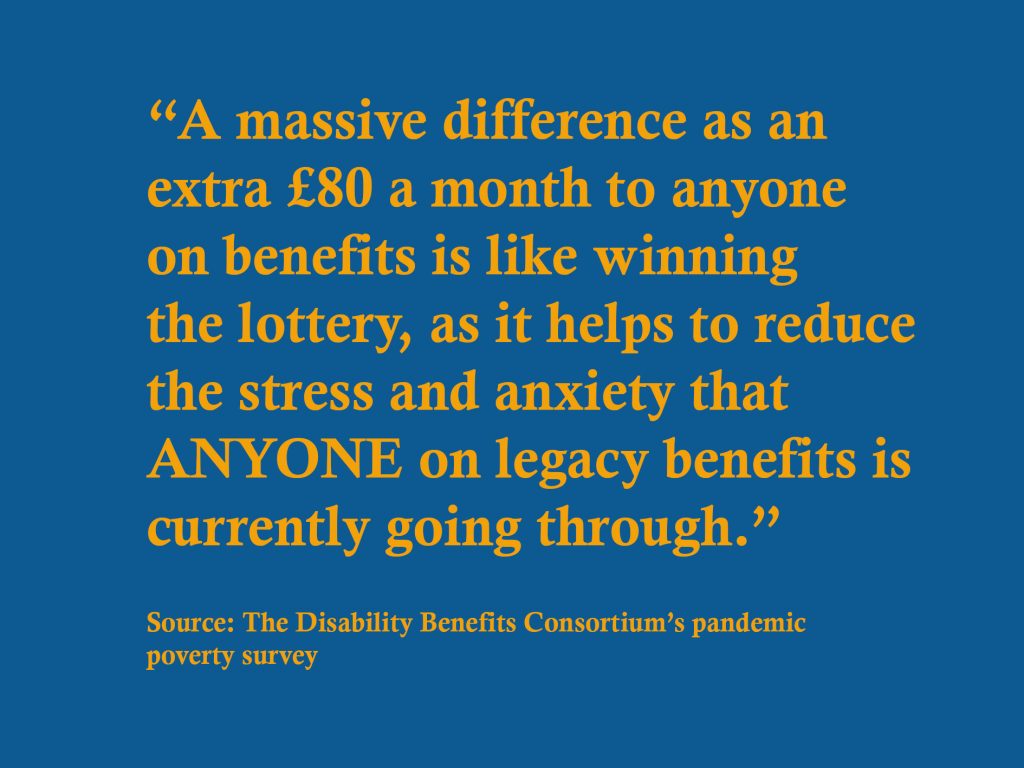

According to the Disability Benefits Consortium’s pandemic poverty survey, 87% of disabled benefits claimants have faced higher spending on food shopping.

However, disabled people like Jo face losing significant amounts of money by switching to Universal Credit, as the new benefits system does not offer any severe disability premiums.

Her benefits currently total £946.18 per calendar month, and if she moves onto Universal Credit she will lose around £290.

Geoff Fimister, Policy Co-Chair of the Disability Benefits Consortium, said: “When there is a change from one benefits system to another, there is usually a pattern of gainers and losers.

“In this case, there are more losers than gainers among disabled people.

“Some people may be better off on Universal Credit because of the £20 uplift, but would then be worse off again if it was withdrawn. And once you switch, you can’t switch back.”

The DBC and other advocacy groups have been pressuring the government to extend the £20 uplift to legacy benefits to support disabled claimants struggling with extra costs during the pandemic.

At first the DWP said that adding the uplift would be too difficult as the IT system used for legacy benefits is much older than the Universal Credit system.

However, given the opportunity to change benefit rates at the November spending review, the DWP only raised legacy benefits by 37p in line with inflation.

Neil Couling, the Director of Universal Credit, said that the intention of the £20 uplift was to help people who were newly unemployed due to the pandemic.

He said: “I couldn’t create a new class of benefit claimants pre-COVID and post-COVID on Universal Credit, so for want of a better phrase, there was a kind of windfall gain for existing Universal Credit claimants.”

Fimister said that targeting the uplift for newly unemployed people could be a political move.

He said: “These are people who are not used to being on out of work benefits and probably have absolutely no idea how low those benefits are.

“Normally the personal allowance for a single person over 25 is only about £70 a week. So around £90 a week isn’t a hell of a lot better, but it’s less of a shock effect.”

However, many legacy benefits claimants who are facing higher living costs due to the pandemic have fewer savings to rely on than those newly out of work.

According to The Joseph Rowntree Foundation, nearly half of the 14 million people living in poverty in the UK either have a disability or live with a disabled person.

Jo said: “At some point in my life, I was paying 60% tax. I have contributed, I have tried to be a member of society and through no fault of my own, I’m now nothing.

“I’ve been told that if people like me just stay indoors everyone could have a normal life, if people like me died then the NHS wouldn’t be in the state it’s in.

“You can imagine when you’re forced to sit in four walls you see some very unpalatable truths about yourself, and one of those is that you feel useless and that you’re a burden.”

Isolation, financial stress and the fear of getting the virus have taken an immense toll on Jo’s mental and physical health, and the MS tremors she used to have once every two months now happen every day.

She said: “I just want to be able to live, I’m not asking for a luxury lifestyle. I wish I had enough money in the bank to pay my bills. I wish I could put the heating up two degrees, or add something to my supermarket shop without worrying about it. I wish I could be secure.”