Kensington and Chelsea has been named the London borough where the largest proportion of the average salary is spent on mortgage repayments, according to new research by Sell House Fast.

The cash house-buyer analysed mortgage and salary data across the UK to identify the areas where homeowners face the greatest financial pressure.

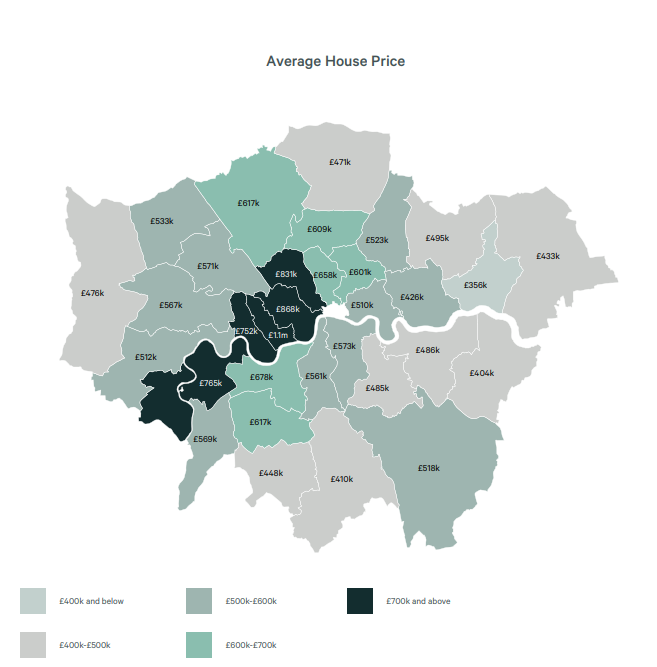

Kensington and Chelsea took the top spot, followed closely by Camden, Westminster, Hammersmith and Fulham, and Richmond upon Thames.

In several London boroughs, the average annual salary would not be enough to cover a full year of mortgage repayments.

Kensington and Chelsea residents spent an eye-watering £70,595 on average towards mortgage costs each year – the equivalent to almost 172% of the average salary in the borough.

Natalie Shepherd, 26, first-time-buyer in London, said: “Entering the housing market is extremely daunting, and looking in London, my options are definitely narrowed.”

| Rank | London Borough | Annual mortgage repayments as a percentage of salary |

| 1 | Kensington and Chelsea | 171.9% |

| 2 | Camden | 134.1% |

| 3 | Westminster | 126.1% |

| 4 | Hammersmith and Fulham | 105.4% |

| 5 | Richmond upon Thames | 96.5% |

Kensington and Chelsea also had the highest average monthly mortgage repayment at £5,882.95, which is more than 1,000% higher than the lowest monthly repayment in the UK, found in Inverclyde, Scotland (£491.26), according to the report.

Buying a home in London has always been expensive, but these figures show just how extreme the gap has become.

Just one of the top 10 places with the highest mortgage burdens falls outside of the capital – Elmbridge in Surrey.

Sell House Fast managing director Jack Malnick said: “A mortgage should feel like a long-term investment, not a monthly source of stress.

“If your repayments are eating up more than 30% of your income, that’s often a sign you’re overextended.

“When essential expenses like food, bills, or savings start slipping, it’s time to reassess – whether that’s by switching to a better deal, adjusting your budget, or exploring a quicker sale if you’re really struggling.”

To see where homeowners were under the most pressure, the cash house buyers at Sell House Fast analysed figures from the ONS Annual Survey of Hours and Earnings with average house prices from the UK House Price Index.

Assuming a 20% deposit and using the Bank of England’s base rate to calculate typical repayment costs, the analysis identified how much of the average local salary goes towards annual mortgage payments in each area.

Read the full report via Sell House Fast’s website.

Feature image: Free to use from Unsplash

Join the discussion