London is the UK’s least financially-open region despite being a global financial hub, new Aqua research shows.

In the UK’s capital, people are notably more inclined to avoid financial discussions, with 11% saying they always avoid the topic and 30% saying they do so often.

This tendency reflects the city’s intense financial competition, high cost of living, and the social pressure to appear successful.

Aqua Commercial director Sharvan Selvam said: “With over nine million people from all walks of life, and some of the biggest income gaps in the country, money can be a sensitive topic in the capital.

“The contrast is everywhere: luxury flats next to food banks, high earners sharing tube rides with people facing financial challenges.

“These daily reminders of inequality can make it harder to talk honestly about our own financial situations.

“There’s also the pressure that comes with ambition. Many people move to London chasing career goals, so admitting you’re finding things tough financially can feel like falling behind, even though money worries are so common.”

People in the North West of England similarly showed a high level of avoidance, potentially indicating unease or stress surrounding financial insecurity.

Home to major cities like Manchester and Liverpool, this region is likely to face a combination of urban financial pressures and persistent regional inequalities.

Despite moderate avoidance rates, Yorkshire stands out for its openness as nearly one in five there say they never avoid financial conversations.

Debt and asking for financial help or support emerge as the most challenging financial topics to discuss for Londoners, with around a quarter saying they would find it tough to ask for financial help.

This is most likely connected to the city’s competitive culture and may feel like failure for some.

Salary and compensation, and financial dynamics within relationships follow closely behind with 20% and 19% of Londoners finding those topics challenging to discuss respectively.

Abigail, 23, said: “It can sometimes be difficult to talk about money with friends, especially when there can be such a discrepancy between us as we go into our 20s.

“Some people are still students, taking gap years or earning lots of money in corporate roles, so it can be hard to broach the subject without alienating people.”

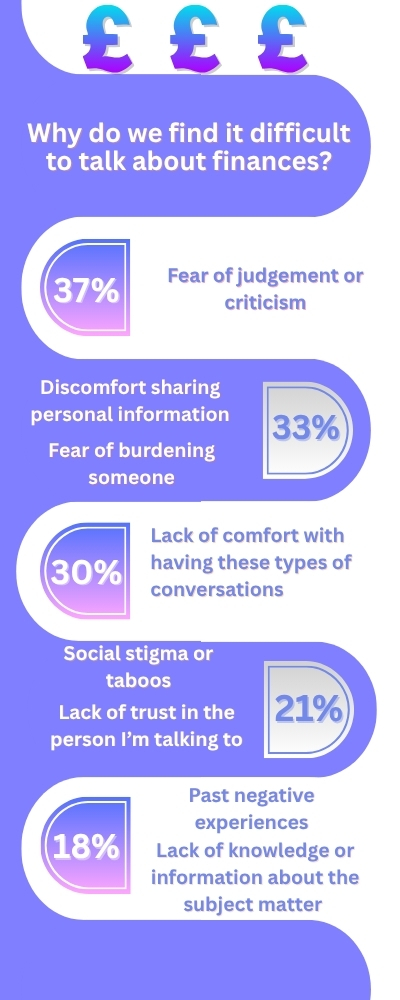

The research found that the primary barrier to conversations around finances is a fear of judgement or criticism, with over a third specifying this reason.

Concerns about burdening others and discomfort around sharing personal information are also notable obstacles, with 33% pinpointing these as a barrier to talking about finances.

Selvam said: “London is one of the most diverse cities in the world, and with that comes different views on whether money is something you should talk about at all.

“For some, it’s normal to be open about finances. For others, it’s more private, sometimes even taboo.”

Creating supportive, non-judgemental environments is an essential element in making discussions around finances easier, with 31% saying this would make them feel more comfortable.

Beyond supportive personal environments, broader challenges remain in discussing money.

Nearly one in five people believe increased social awareness and education on handling financial conversations would help reduce the discomfort surrounding the topic.

Selvam said: “If we want to make money conversations feel normal, they need to start early and happen often.

“This means bringing them into schools, workplaces, and everyday life in a way that’s open, honest, and easy to understand.

“Social media has definitely shaken up the way we talk about money. From budgeting tips on TikTok to debt diaries on YouTube, conversations that used to happen behind closed doors are now out in the open, and that’s changing things everywhere.

“More and more people are sharing their financial wins and struggles online, often to keep themselves accountable or help others feel less alone.

“For young Londoners especially, seeing real people talk honestly about money can feel refreshing. It builds a sense of community and normalises what used to feel like taboo topics.

“In some ways, London is becoming more financially open among younger generations who’ve grown up with these platforms.

“But, there’s still a gap between accessing financial content and trusting it. Londoners might be seeing more money talk than ever before, but many still look to traditional sources when it comes to serious decisions.”

Featured image credit: kschneider2991 on Pixabay.